Today, you’ll learn about a powerful tool to reinvigorate your marketing: the RFM model.

Coined by Hughes in the ’90s, RFM is a tried and tested segmentation model which gets results.

It has an impressive track record: top brands like L’Occitane have seen their income increase by 25 times by using this RFM model. And because it’s simple, small companies can benefit from it too.

Here, we’ll take you through how to conduct your own RFM analysis to boost your conversion rates.

RFM segmentation is a data-driven tool which helps you get to know your customers. It’s based on the principle that you need to understand how they buy, not just who they are.

This model groups your customers based on their spending behavior. It tells you how they’ve interacted with you in the past. Who has been loyal through thick and thin? And who is a flaky one-time shopper?

With this data, you can then create targeted marketing campaigns. Your voice gets lost when you’re trying to reach a vast range of people with a single message.

But RFM segmentation allows you to send your customers high-value, focused communication that’s relevant to them. You’ll put your marketing resources where they matter most and enjoy a higher customer lifetime value.

With RFM segmentation, you’ll be able to identify customers like:

For now, let’s get into how this model really works.

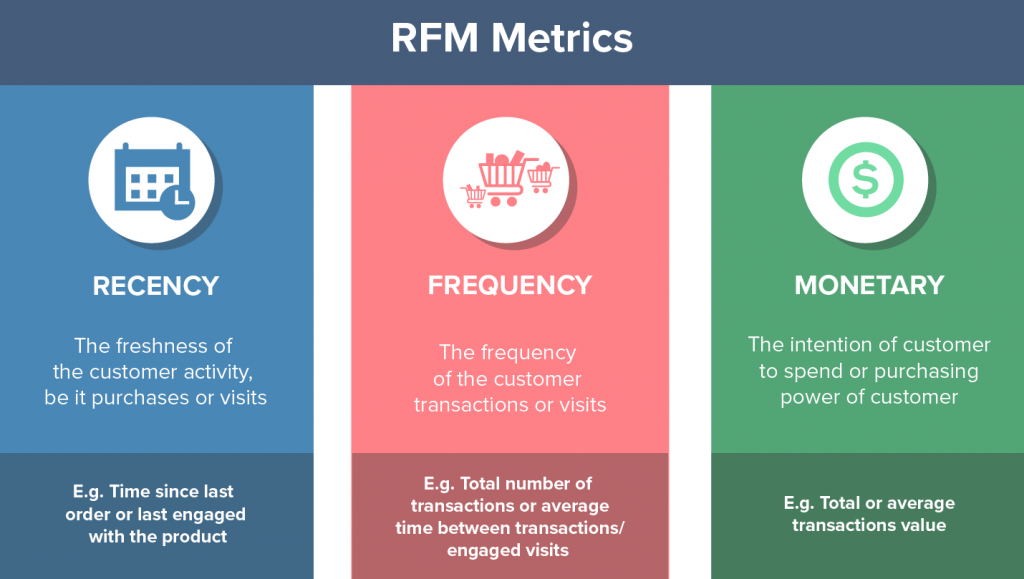

The RFM model is built on three pillars: Recency, Frequency, and Monetary. It uses these factors to analyze your customers’ spending history.

When analyzing RFM, you ask three questions of every customer:

You’ve got a better shot at targeting customers who’ve transacted recently with you. The fresher a purchase, the more responsive they’ll be to your messaging.

Here, you’re looking for frequent buyers. This measure tells you how loyal they are to your brand — and therefore how valuable.

You’re keeping an eye out for the big spenders with this one. They’re more willing to cough up for luxury items.

In some cases, Engagement (E) can take the place of Monetary (M). This is a useful metric if your ‘product’ isn’t traditional. Take ad revenue, for example. You could tally the visit duration, time spent per page, and the number of pages visited per user instead of the money they spent.

Put these three RFM factors together, and you’ve got a powerful analytic tool. You’ll get deeper insights into how your customers spend, and therefore how you can best target them.

Now you know the theory, it’s time to put the RFM model into practice.

The great news is that RFM calculation is pretty simple for anyone to do. While there are paid RFM model kits that do it automatically for you, the process is fairly easy to do yourself. All you need is a laptop and clear instructions. (We’ve got that last one covered.)

Here’s how to calculate RFM in 4 easy steps with an RFM model example:

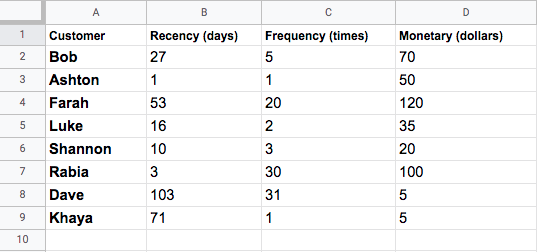

To start, you’ll take your company’s raw transaction data. Take each customer’s buying history and assign them an R, F, and M value.

If you need a refresher:

Especially if you’re a beginner, RFM models work well in Excel. But Python or r make good RFM models too if you have the skills. Besides, you can configure any of Excel integrations to use RFM data for reporting or within other tools.

After you do this, your Excel sheet should look something like this:

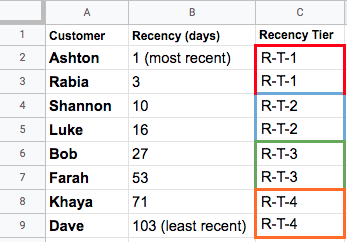

Next, you’ll need to calculate each customer’s RFM score. To do that, you first need to sort the R, F and M data, and then create 4 tiers. If you’re dealing with a lot of data, you could make 5 tiers — or 3 if you have less data. We prefer 4 as it makes manual calculation simple.

Sort each R, F, and M value in order such that your ‘ideal’ customer behavior ranks first. If we took Recency, for example, the ideal behavior is purchasing recently. So recent buyers would rank first.

You then need to segment that data into 4 tiers: T-1 (Top score), T-2 (Upper middle), T-3 (Lower middle), and T-4 (Bottom).

If we did that with the Recency data from our example, that would look like this:

Repeat this process for the other 2 values, F and M. By the end, every customer should have individual tiered values for Recency, Frequency, and Monetary.

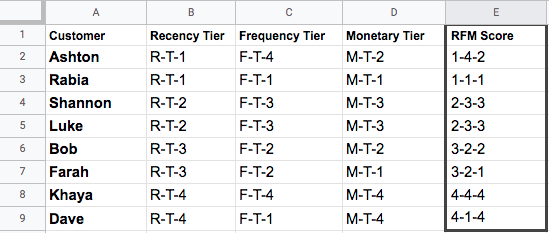

To calculate their combined RFM score, all you have to do is place these tiered values alongside each other:

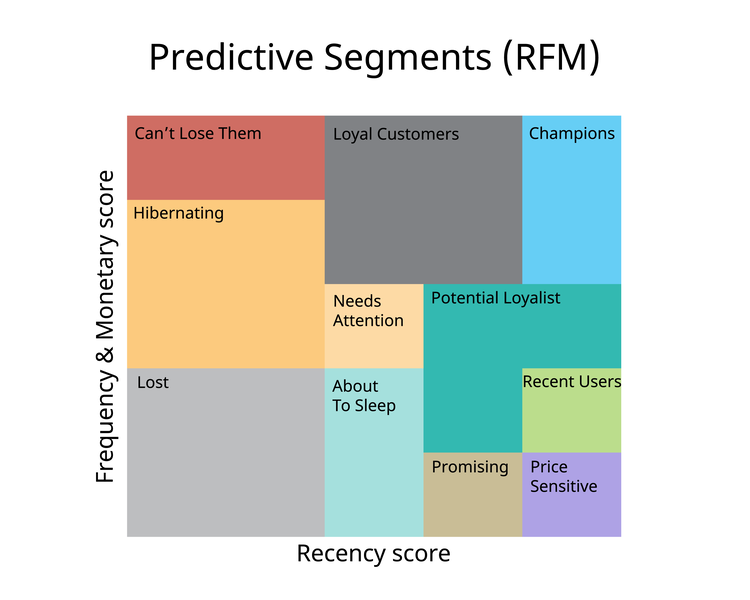

Now that every customer has an RFM score, you can split them up into groups, so you can form a targeted marketing strategy. It helps to give them names.

For your RFM model example, you might focus on:

Of course, the labels you give these segments are up to you. You’ll have to figure out what works best for your context.

By breaking your customers down like this, you can then send out messages that resonate with each of these categories.

For example, you might target a group like this:

With RFM calculation, you can reach each customer — and win their loyalty. When done right, RFM modeling makes your marketing more compelling. But it’s not without its shortcomings, as we’ll get to later.

First, let’s take a look at why you should be using RFM:

Because it’s backed by hard data, RFM gives you an accurate analysis. It’s calculated quantitatively, so it’s free from human bias.

Other more traditional analytic methods simply don’t do this. For example, sampling risks arbitrarily picking people who aren’t true representatives of your customers. And other segmentation methods might unfairly skew towards variables like demographics.

With RFM, you can send out personalized brand messages that are suitable for each group of customers, while still at a large scale. It helps you focus your marketing efforts on each group instead of sending out generic communication. That makes it a great option if you’ve got limited time and money available.

By doing this, your message tells your customer that this brand understands them and their needs. A relevant message can reactivate old customers, and incentivize your best ones to keep buying. Ultimately, you’ll get more engaged and loyal customers.

Market research can get complicated. And costly. What makes RFM popular is that it’s fairly easy and low cost to use. Sure, you can buy RFM model kits to do the hard work for you — and there are some great tools out there. But like we’ve shown, RFM model calculation can be straightforward with some instruction. This means it’s accessible to businesses of all sizes.

It’s not about how many customers you can attract. It’s about how many you can keep.

Because of the digital marketplace, every customer has an overwhelming number of options competing for their attention. In this climate, customer acquisition is no longer the name of the game. Customer retention is what matters.

With RFM, you work out who your most valuable customers are and reward their spending behavior. This targeted approach results in higher retention. They’re more likely to stay when they feel valued and satisfied with the service.

There are drawbacks to using RFM, however. If you use it in isolation, the analysis can be misleading. Here are a couple of things to be careful of when using RFM:

RFM can’t tell you everything. It relies on only 3 factors, whereas other analytic tools use a more exhaustive data set. By honing in on these 3, you may exclude other important data, like location or demographics.

A good way to get around this is to supplement your RFM analysis. For example, adding qualitative data research can give you a fuller picture of your customer’s spending habits. By conducting customer interviews, you’ll be able to really get to the nuts and bolts of why they’re spending in a certain way. (Something RFM doesn’t really show.)

It’s tempting to assume that your customers will continue spending in the same way in the future. But that’s not necessarily true. RFM models only analyze past customer data. That might not be helpful in predicting future behavior, given trends or future activities. To get around this, consider using predictive tools in conjunction with RFM.

And finally, the RFM model can produce skewed results. For certain business models, each of the 3 factors might not be useful metrics:

There’s a reason RFM has been kicking for 25+ years. It works. If you’re a scrappy start-up, or an old hand in a bit of a rut, RFM can give your marketing campaign new energy. With just a simple analysis, you can build relationships that matter with customers that will stick with you.

So use our guide to take a shot at it yourself!

RFM segmentation is a way of analyzing groups of customers by looking at their purchasing history. It helps you determine who your most valuable customers are based on their spending habits, so you can target them in a focused way.

RFM stands for recency, frequency, and monetary. Each is a factor used to analyze a customer’s value. Recency tells you how long ago they transacted with you. Frequency tells you how often they transacted with you. And Monetary tells you how much they spent.

RFM can be a powerful tool for making targeted marketing campaigns. It gives you insights into how your customers spend, so you can send personalized communication to them, so they’re more likely to be engaged with and loyal to your brand.